Identify, engage and close key accounts with BNZSA's Opportunity Finder

It’s a no brainer that sales teams are always going to look for ways to maximise their MQL and SQLs to closed won conversion rates. And as we face further economic uncertainty, it is even more vital for sales and marketing teams to ensure today’s budgets that are heavily scrutinised are invested wisely to secure a solid ROI.

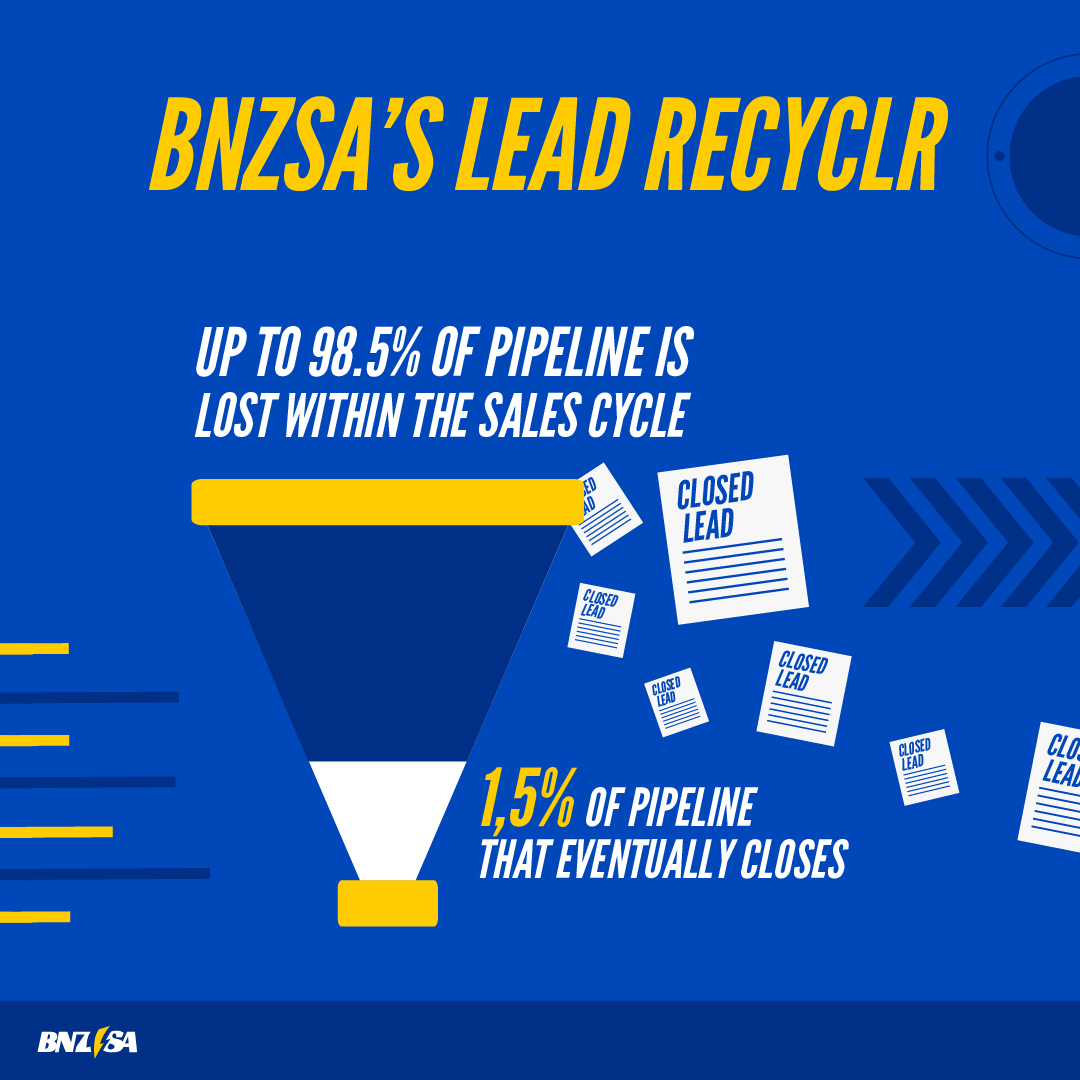

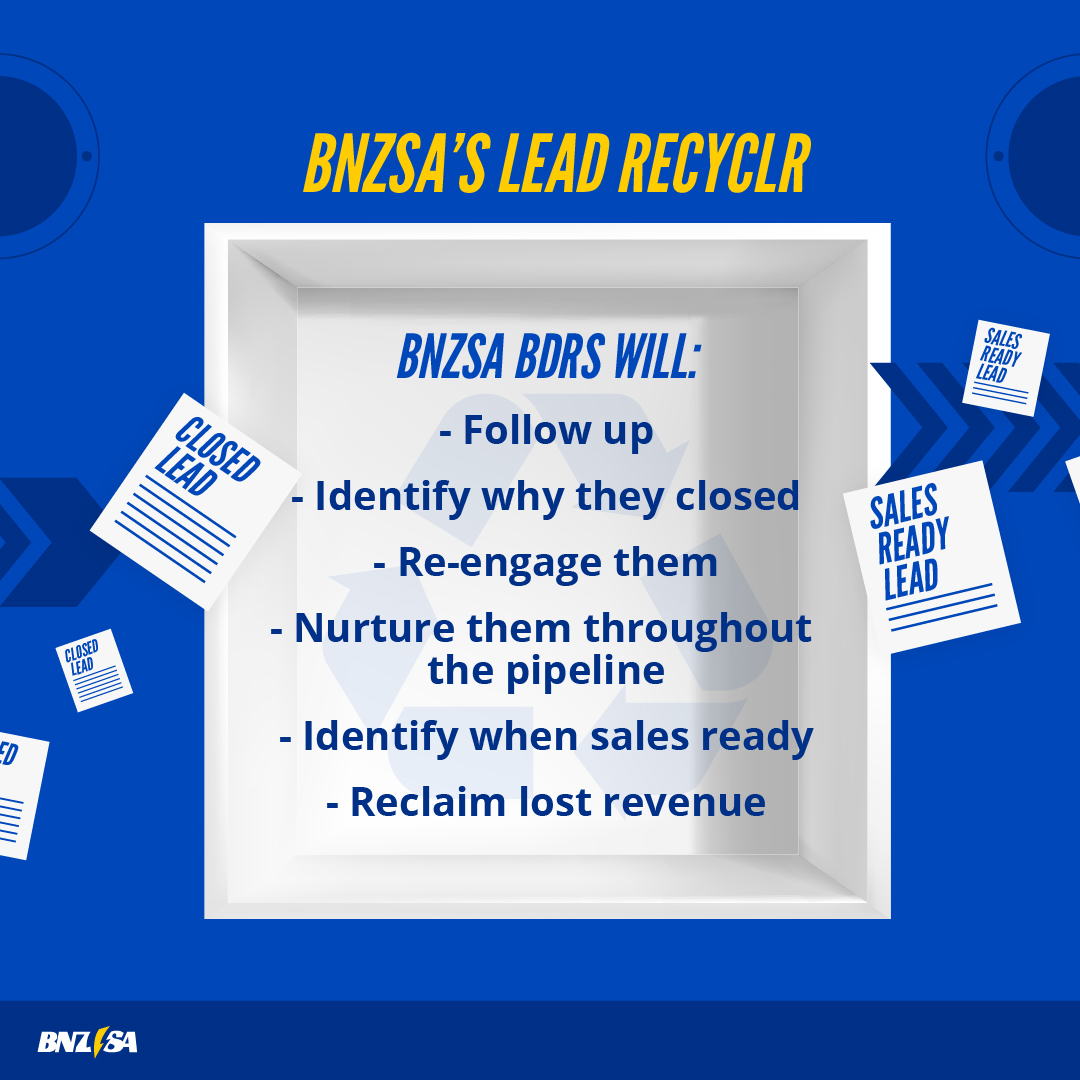

Despite being a key component for sales pipelines for many years, lead generation is often not as efficient as it could be, leading to a lot of waste. Companies handle leads from multiple agencies which are not accurately qualified. This results in up to 98.5% of pipeline being rejected by sales because it’s not a tangible opportunity.

Optimising your pipeline generation and activation requires applying various strategies along the sales funnel in order to fully engage and convert prospects to opportunities effectively.

This can be hard to get right at every step. It requires sales and marketing teams to firstly be aligned, to have access to quality data, relevant contacts, effective content, and actionable insights. It also often means combining data from various sources.

Sales and marketing teams are often inundated with all the latest technologies, platforms, and services to facilitate and automate lead generation. Technographic and firmographic segmentation provides top of the funnel insights, but this data is often disjointed or lacks clear insights to aid conversion into actual opportunities. While this data can be valuable, it lacks context and opportunity defining detail.

One key issue is that “lead” is an all-encompassing term that can include everything from a simple opt-in to a Sales Qualified Lead, but using the term lead itself does not necessarily tell you whether it is likely to close or not.

There is a clear gap in the market for a solution that provides insights for an efficient whole funnel solution which maximises pipeline generation, transforming leads to opportunities. To make this a reality, it is necessary to combine data, digital and human interaction to identify credible and qualified opportunities.

BNZSA’s Opportunity Finder

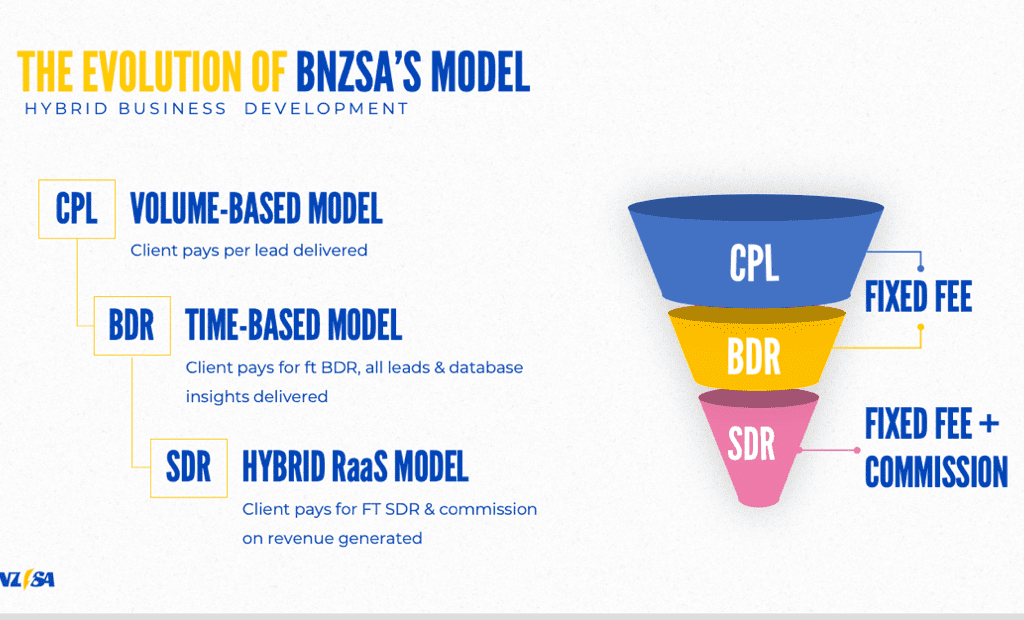

Opportunity Finder by BNZSA is a fully integrated solution, combining some of the most advanced lead generation tools. It is designed to increase sales and marketing effectiveness as we noticed a gap in the market for an end-to-end lead generation engine that converts to closed revenue delivering quantifiable ROI.

Combining data and digital engagement with human outreach, Opportunity Finder is the most effective toolbox to identify real revenue-generation opportunities that have the best possible chance to close.

It provides insights which maximises the impact of campaigns and furthers our understanding of the market and the signals BNZSA is receiving from prospects. This allows companies to supercharge go-to-market strategies and accelerate pipeline faster.

Opportunity Finder is comprised of five key pillars to make sure each lead will move through the sales funnel. Rigorous processes are put into place to efficiently engage, qualify, and most importantly convert leads to closed won opportunities.

Enrich

Build your universe by enhancing your database with as much key information as possible about your target accounts.

Find

Find the right decision makers, identifying buying committees, and strategize how to best land your messaging.

Ignite

Combining intent data with first touch - digital and telemarketing engagement - to filter and segment the audience.

Engage

Deploying the right engagement strategies across the digital and telemarketing toolbelt to connect with decision makers.

Close

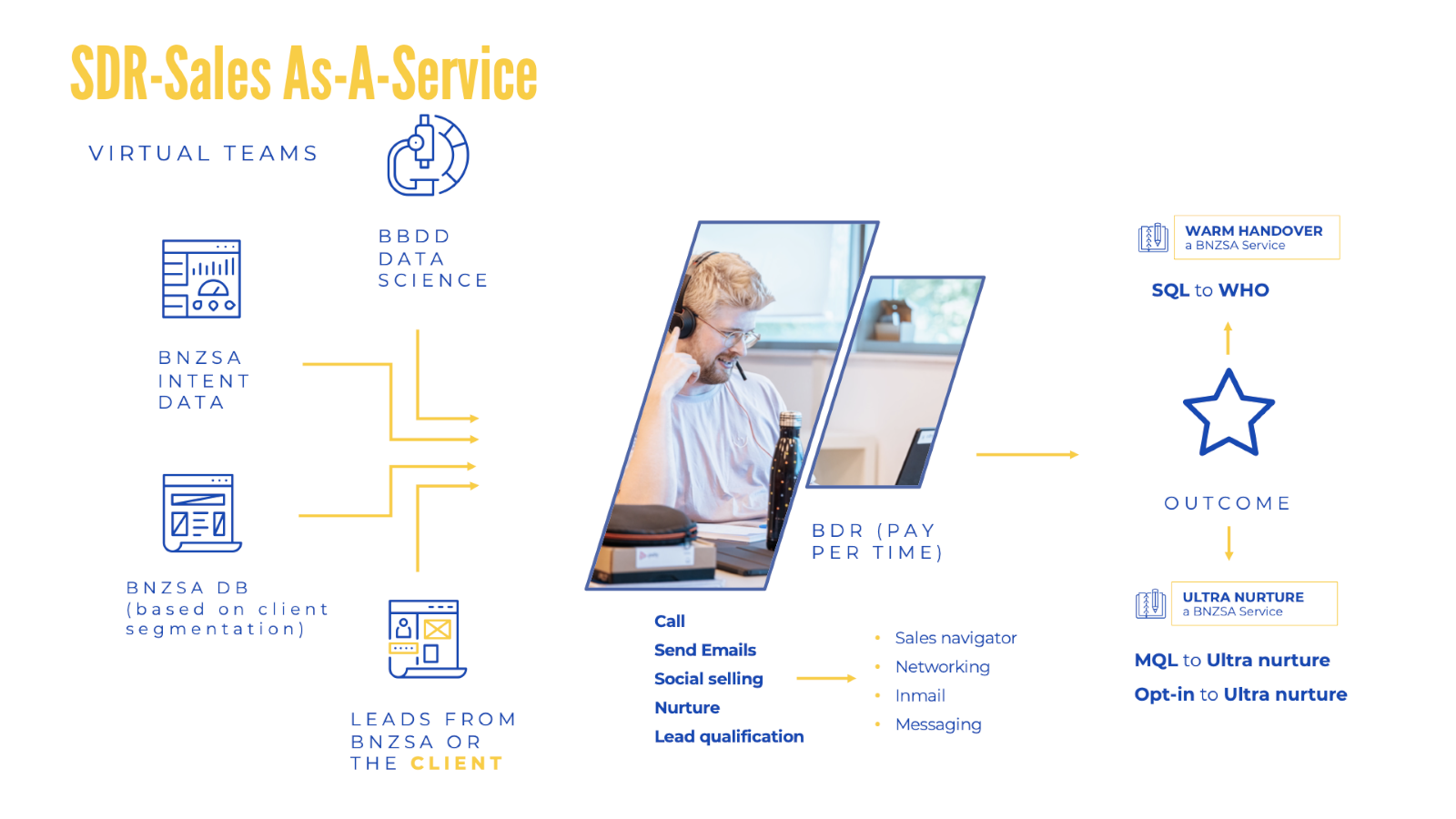

Using highly skilled BDRs/SDRs and advanced digital nurture to close the deal or deliver SQLs using our Warm HandoverTM and Sales-as-a-service processes.

Opportunity Finder - A Case Study

BNZSA recently launched an Opportunity Finder for a client – an industry leading recruitment software provider. The objective of the campaign was to generate 100 qualified opportunities and 150 MQLs for the client.

Enrich:

BNZSA’s Data and Decision Science teams combined first and third-party data to enrich the database with information intent data about 4,500 companies. We added firmographics, technographics, key market insights and anything additional that might inform their buying behaviours.

Find:

BNZSA’s team of Data Researchers identified 6,000 contacts that comprised of the Ideal Customer Profile (ICP) from the 4,500 companies. This included various buying influencers as well as the key decision makers.

Ignite:

BNZSA then launched a telemarketing campaign as a first touch to gather consented MQLs and Opt-ins.

Engage:

The consented contacts were passed to the digital marketing team for digital follow-up with email nurturing.

BNZSA implemented two separate email marketing strategies:

1. To nurture MQLs/Opt-ins to try convert to a scheduled meeting

2. To keep converted prospects interested by sending a meeting reminder and additional relevant content before the meeting.

As well as email nurturing, we created a microsite in the local language which acted as a key content hub to educate the prospects and push them through the funnel for conversion. BNZSA was able to drive traffic to this landing page and track the prospects’ behaviour and understand their areas of interest.

The nurtured contacts were then followed up via telephone outreach by BNZSA BDRs with the aim of booking meetings with additional prospects. Once the meeting was booked, the contact was sent custom content and meeting reminders, which lead to a higher meeting attendance rate.

Our BDRs were also able to gain additional contextual insights into purchasing cycles and buying committees through their conversations with decision makers.

Close:

The meetings that were scheduled were executed using BNZSA’s Warm HandoverTM process – a three-way call between BNZSA’s BDR, the prospect and a sales rep from the client.

Results:

- Delivered over five times the original MQL & Opt-in target.

- 652 of these MQLs/Opt-ins were added to digital nurturing tracks.

- 148 sales opportunities were identified – almost 50% higher than target of 100.

- 65% of the executed meetings were high potential opportunities and were sent an offer by the client.