Enhance ROI from B2B events by investing marketing development funds (MDF) in BNZSA Channel Concierge, to get in front of the right people

Despite the increasing ability to order IT products and services online, three tier distribution or “the channel” has always been an important route to market for vendors, especially in the sub enterprise space to secure and renew long tail business.

To enable channel partners to prospect new customers and service existing ones, vendors have traditionally put aside vast amounts of marketing development funds (MDF) to support distributors in holding stock, enabling credit lines and to support marketing campaigns that are provided to Value Added Resellers (VARs) and Managed Service Providers (MSPs)

This successful model was perhaps the reason why previously direct selling champion, Dell Computers, has become one of the largest indirect selling channel companies in the world.

Pre-pandemic, MDF funding was largely invested into face-to-face events, with one major enterprise software vendor spending over 80% of its MDF on events to generate leads alone.

And while during the pandemic and going forward channel companies are looking to do more digital marketing to generate brand awareness and to generate leads, events are making a strong comeback in the B2B world, especially for the channel.

Despite research claiming that users in the future will increasingly want less interactions with sales folk; People, it seems, still currently prefer to buy from people.

And what is better than having a conversation with an interested user that has come to your stand or requested a meeting in person. No Zoom, no Teams, no need to ask for consent, no cold calling, no irrelevant email in an overflowing inbox.

But for those that have organised or participated in events will know, putting on events is never easy.

Maximising Marketing Development Funds (MDF) via events

Events are strategic opportunities to forge strong connections and generate high-quality leads. However, organizing events can be resource-intensive, involving considerations such as securing stand space and having suitable marketing to adorn it, covering sponsorship fees, managing travel costs, accommodation, and more. Demonstrating a return on investment (ROI) is a constant challenge, demanding not only many attendees but also the right ones who will convert into revenue.

This is where MDF is hugely beneficial for channel partners. By allocating these funds to events, IT providers empower their partners to host impactful gatherings, providing a platform to showcase products and solutions. Done well, it is an investment in meaningful interactions that can translate into long-lasting relationships and substantial business growth. Done poorly and it can be an easy way to burn through funds that could have been better deployed to generate pipeline.

BNZSA's new Channel Concierge service

When staying at a decent hotel in a place you are unfamiliar with, the hotel concierge service is often the difference between having an excellent stay rather than just a good one. Not only can they recommend you the best restaurants in town, but they also often have the ability to book good tables at them that might not be available if you just rang or turned up on spec. They also can exchange their knowledge about attractions and provide advice on which ones to prioritise. All in they provide the human verification on top of the digital information you may have searched for in

BNZSA's Channel Concierge (BCC) service has been designed in the same way to help channel partners with the heavy lifting involved in providing marketing services, to attract new opportunities including events so they can concentrate on what they are good at, selling! To this end, BCC, is a centralised, fully integrated Marketing-as-a-Service platform tailored for channel partners. It is not just a service; it is a strategic ally that empowers your partners to fuel their lead generation strategies across many platforms to culminate in the climax of your marketing activity, F2F events.

By allocating MDF to Channel Concierge the service will provide:

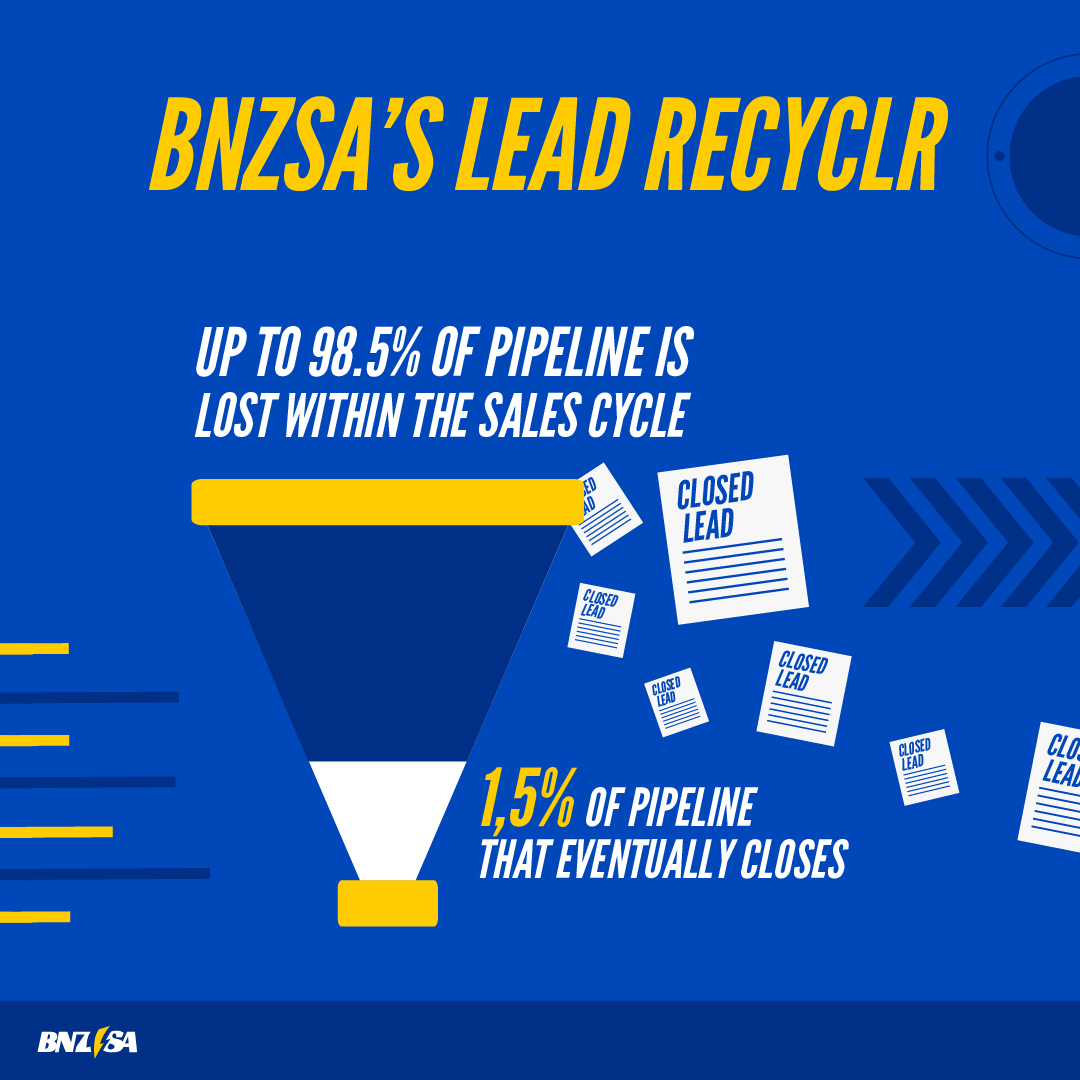

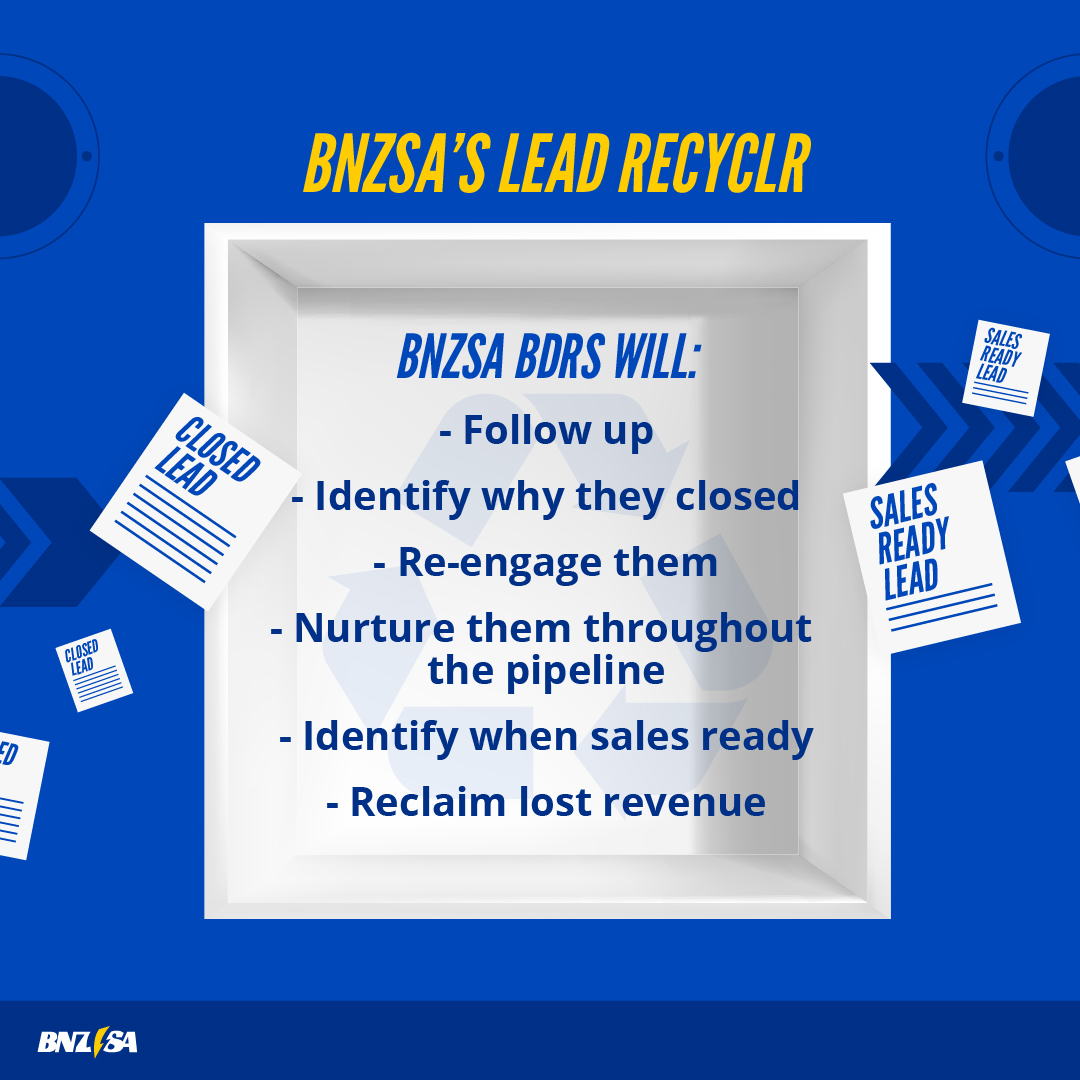

- Maximised Event Follow-up with Lead Verifyr:

Lead Verifyr by BNZSA is powered by our team of highly trained BDRs and is designed to make your pipeline work harder and is the perfect solution to maximise post-event conversion rates. BDRs will contact the list of attendees who engaged with our client pre-event or at the event itself to verify contact information and evaluate the lead. Those contacts who are identified as being a tangible sales opportunity will be invited to a three-way call with both BNZSA’s BDR and a sales representative from the client, using BNZSA’s unique Warm HandoverTM (WHOTM) method. - Bespoke Campaigns to Empower your partners:

Channel Concierge offers the flexibility to create bespoke marketing campaigns or choose from out-of-the-box packages. This means partners can tailor their efforts to align perfectly with your latest messaging and product offerings. It centralizes partners' marketing endeavours, ensuring that campaigns are always current and effective.

- Proactive Demand Generation Focus:

BNZSA's Channel Concierge is built on a foundation of proactive demand generation. Each campaign is backed by a dedicated native speaker and is powered by BNZSA’s data team to ensure localised and precise targeting across all marketing channels and international markets.

- Dedicated Programme Managers for Unparalleled Support:

With Channel Concierge, partners benefit from the expertise of Programme Managers who possess extensive experience in running multi-channel marketing campaigns. These managers serve as the main point of contact, providing support throughout the entire process. This level of personalized attention ensures that partners feel supported and empowered in their marketing efforts.

- Elevated Content Excellence:

BNZSA's in-house design and digital team is poised to create bespoke content for partners. This includes crafting compelling landing pages, designing email nurturing tracks, and executing paid media and programmatic advertising. This comprehensive approach to content ensures that partners have the tools they need to captivate their target audience effectively.

- Global Reach with Native Language Coverage:

Whether you are targeting markets in EMEA, North and South America, or APJ, BNZSA's services are accessible globally. With native language coverage in all key markets, there are no limits on the number of markets or concierge resources per market. This means you can reach your ideal customers, no matter where they are based.

By providing partners with the tools, support, and expertise they need, Channel Concierge paves the way for success in today's competitive IT market. Discover true ROI by investing MDF in Channel Concierge and unlock a new level of collaborative growth with your partners. They might also know some of the best spots to go to in Madrid, if you ask them!

Additional reporting by Paul Briggs, Director of Global Corporate Development